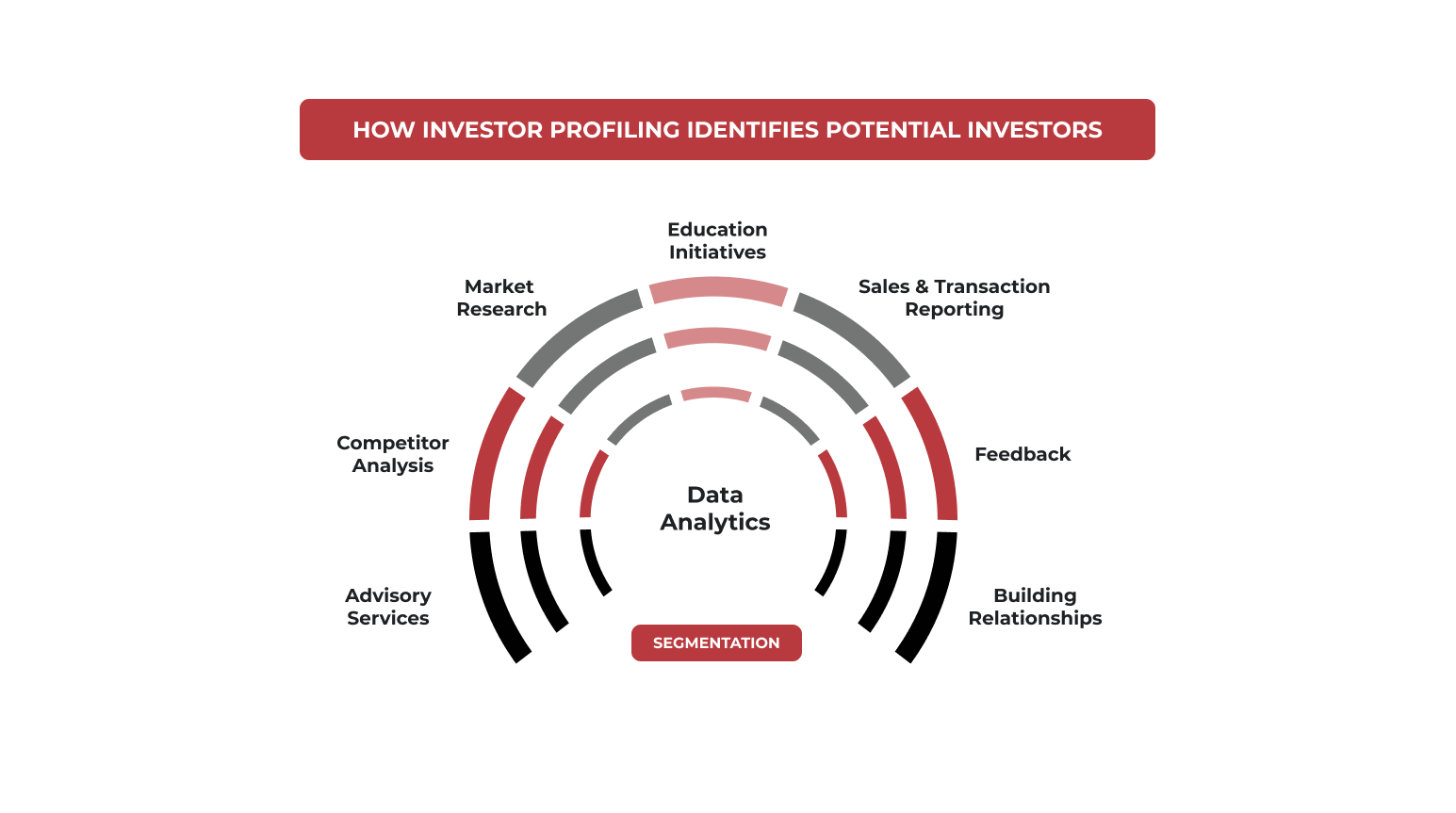

Understanding the profile and preferences of potential investors is vital for a mutual fund company’s fundraising and investor engagement strategies. To do this effectively, a comprehensive approach is needed, involving several key steps:

Market Research: Conducting thorough market research is essential. This involves analyzing demographic data, investment trends and economic conditions to understand who potential investors are and what they are looking for in investment products. Surveys, focus groups and industry reports can also provide valuable insights.

Investor Segmentation: Segmenting the market based on investor characteristics such as age, income, investment goals, risk tolerance and investment experience allows for a more targeted approach. Different segments may have different investment preferences and needs.

Understanding Investor Behavior: Behavioral finance studies can provide insights into the psychological factors influencing investor decisions. This understanding can help in designing funds that appeal to the behavioral biases and preferences of target investor groups.

Leveraging Data Analytics: Utilizing data analytics tools to analyze existing and potential investor data reveals patterns and preferences that might not be apparent through traditional analysis.

Feedback Mechanisms: Establishing channels for receiving feedback from current and prospective investors is very informative. This can be through direct conversations, surveys or social media interactions.

Competitor Analysis: Understanding what competitors offer, how they position themselves and how successful they are can help identify gaps in the market and opportunities for differentiation.

Regulatory Compliance and Investor Protection: Keeping abreast of regulatory changes and focusing on investor protection can help in building trust and a strong reputation among potential investors.

Technology Adoption: Using technology to create more personalized experiences for investors can be a key differentiator. This includes the use of robo-advisors, mobile applications and personalized investment platforms.

Educational Initiatives: Offering educational resources can attract investors who are new to mutual funds or those looking to understand specific investment strategies better.

Building Relationships: Engaging with potential investors through seminars, webinars and investment events can build relationships and trust, which are crucial for understanding investor needs and preferences.

Monitoring Changes: Investor preferences can change over time due to various factors like market conditions, economic shifts and life events. Continuously monitoring these changes is vital for staying relevant.

Advisory Services: Offering advisory services can help in understanding individual investor needs more deeply, thus enabling mutual fund companies to tailor their products and services accordingly.

By employing these strategies, mutual fund companies can gain a deeper understanding of potential investors’ profiles and preferences, enabling them to design and market their funds more effectively, leading to successful fundraising and long-term investor engagement.