The Unique Value Proposition (UVP) of your mutual fund offering serves as the cornerstone of how you differentiate your funds from those of your competitors. Your UVP encapsulates the distinct benefits and advantages that come with investing in your mutual funds. You will identify your UVP by close examination of your sales and transaction trends and comparative analysis of the competitive landscape.

Your UVP will speak directly to the needs and preferences of your intended audience, ensuring that the message is both clear and compelling. This requires a nuanced approach, one that communicates the value of your offerings in a manner that not only resonates with but also appeals to your target market.

Investment Strategies

When crafting your UVP, it’s imperative to dive deep into several critical aspects of your mutual fund offerings. First and foremost, your investment strategies stand at the forefront. These strategies should not only be innovative and sound but also tailored to meet the varying investment goals and risk tolerances of your investors. Detailing the methodologies you employ to select investments and manage portfolios can help potential investors understand what makes your approach unique.

Performance History

Another key element to consider is the performance history of your funds. Investors often look to past performance as a guide to future potential, even though it’s not a guaranteed predictor. Highlighting your funds’ track records, particularly how they have navigated different market conditions, can serve as a testament to your fund management expertise and investment strategy effectiveness. This aspect of your UVP can significantly influence the investment decision-making process, offering reassurance to prospective investors about the potential for achieving their financial goals.

Fee Structure

Fees and expenses are also a critical factor in the decision-making process for investors. Your UVP should clearly articulate how your fee structure adds value, perhaps by being more competitive or transparent than those of your competitors. This includes management fees, administrative fees and any other costs associated with investing in your funds. A clear explanation of your fee structure, along with how it compares to industry averages, can help investors feel more confident in their decision to invest with you.

Customer Service

How well your investors are served is another distinguishing feature that should be highlighted in your UVP. Exceptional customer service can significantly enhance the investment experience, making it a key component of your overall value proposition. This may encompass personalized investment advice, responsive support teams and access to fund managers or detailed reports on fund performance and strategies. Demonstrating your commitment to serving your investors well beyond the point of investment can set you apart in a crowded market.

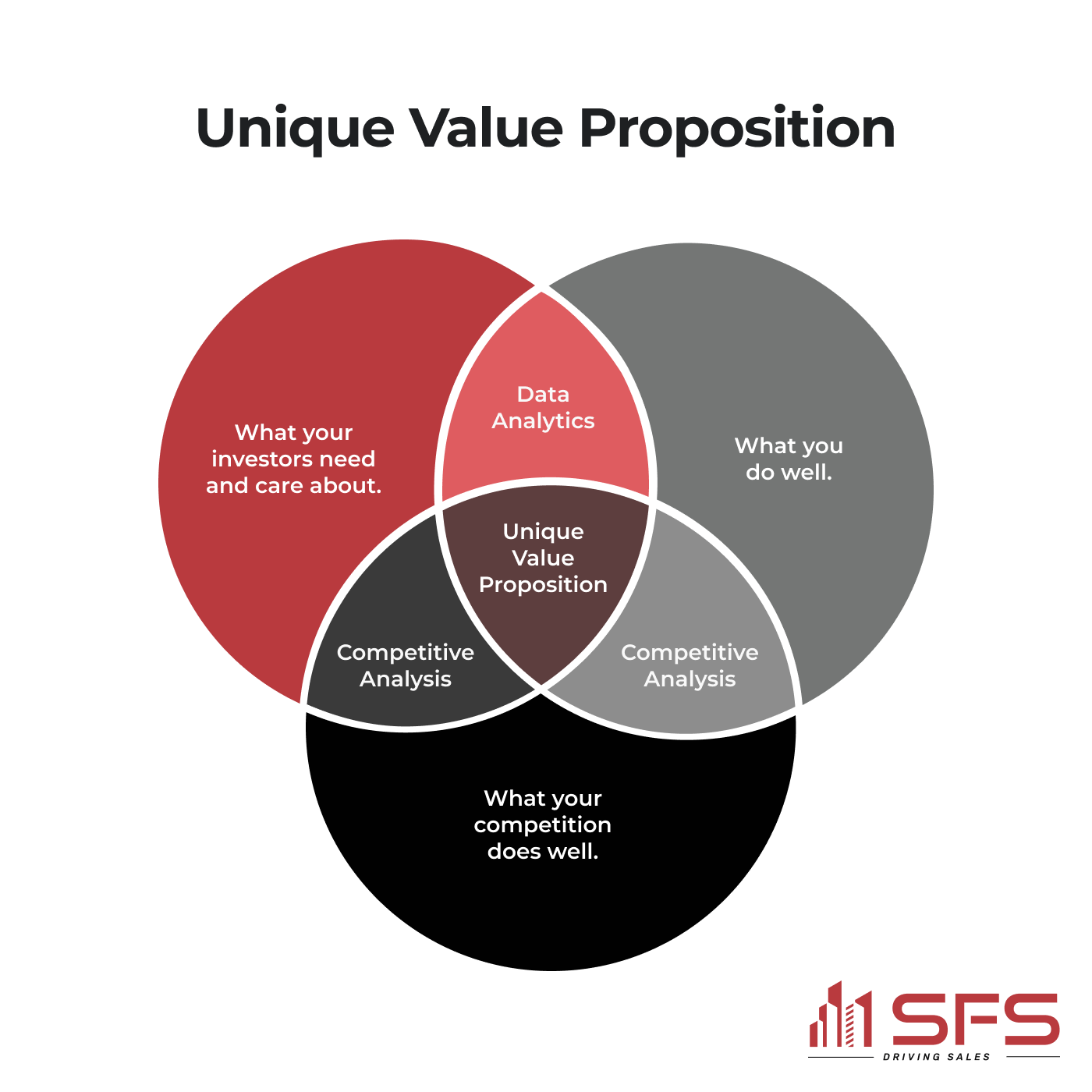

Insights from your sales data analytics and competitor analysis will isolate your fund's Unique Value Proposition.

Your Target Audience

Underpinning your UVP should be a deep understanding of your target audience—their financial goals, risk tolerance, investment preferences and the specific challenges they face. This understanding enables you to tailor your messaging to resonate more deeply with potential investors, addressing their needs and how your mutual funds offer the solutions they seek.

Your UVP is not just a statement of what you offer. It’s a reflection of how well you understand your target market and how your mutual fund offerings are uniquely positioned to meet their needs. By focusing on your investment strategies, highlighting your performance history, being transparent about fees and expenses and underscoring your commitment to customer service, you can craft a UVP that distinguishes your funds in the marketplace and aligns closely with the preferences and needs of your target audience.